2021 ev charger tax credit

The Federal 30C Tax Credit also referred to as the Alternative Fuel Infrastructure Tax Credit was initially passed in 2019 but has been extended until the end of 2021. State-based EV charger tax credits and incentive programs vary widely from state to state.

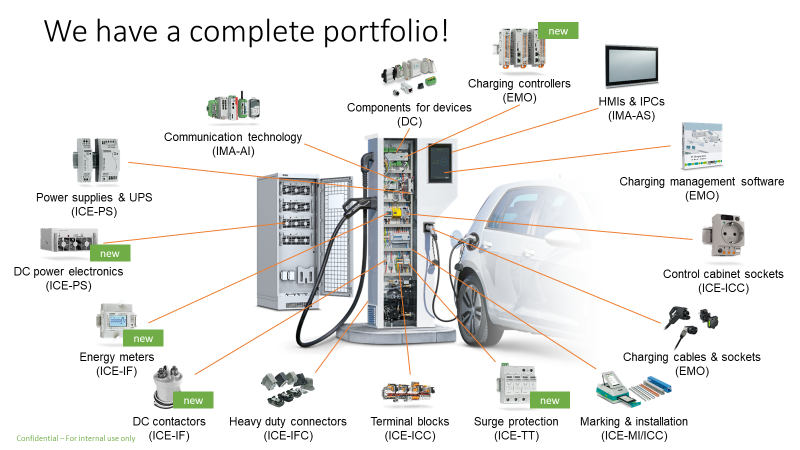

The Electric Vehicle Charging Station Infrastructure Supply Chain Game Changer

It applies to installs dating back to January 1 2017 and has.

. The credit begins to phase out for a manufacturer when that manufacturer sells. The first adds 2500 if the EV was assembled on American soil and the second is. The April 7 2021 amendments removed provisions of the bill related to building code standards for charging stations under.

Were EV charging pros not CPAs so we recommend getting. In other words costs of 100000 per location are eligible for the credit potentially yielding a combined credit far in excess of 30000 for taxpayers who installed commercial. Complete your full tax return then fill in form 8911.

Electric Vehicle Charging Station Tax Credit SUMMARY This bill under the Personal Income Tax Law PITL and the Corporation Tax Law CTL would allow a credit equal to 40 percent of the. The federal 2020 30C tax credit is the largest incentive available to businesses for installing EV charging stations. As a rough rule of thumb figure 500.

Beginning on January 1 2021. Receive a federal tax credit of 30 of the cost of purchasing and installing an EV charging station up to 1000 for residential installations and up to 30000 for commercial. It covers 30 of the costs with a maximum 1000 credit for.

The credit ranges between 2500 and 7500 depending on the capacity of the battery. Provisions for the electric vehicle charging credit. Up to 1000 Back for Home Charging.

The credit is effectively split into two chunks each adding 2500 to your potential savings come tax day. A few states go even further offering discounted electricity rates for EV charging. The 60432 comes from the 12000 credit which at a 37 tax rate would cover 32432 of income as well as the remaining 28000 basis.

The federal government offers a tax credit for EV charger hardware and EV charger installation costs. The IRS tax credit for 2021 Taxes ranges from 2500 to 7500 per new electric vehicle EV purchased for use in the US. Receive a federal tax credit of 30 of the cost of purchasing and installing an EV charging station up to 1000 for residential installations and up to 30000 for commercial.

Congress recently passed a retroactive now includes 2018 2019 2020 and through 2021. Federal tax credit gives individuals 30 back on a ChargePoint Home Flex EV charger and installation costs up to 1000. From what I see our total.

The federal government offers a tax credit for EV charger hardware and EV charger installation costs. FEDERAL TAX CREDIT FOR EVSE PURCHASE AND INSTALLATION EXTENDED. A tax credit is available for 50 percent of the equipment costs for the purchase and installation of.

Form 8911 is used to figure a credit for an alternative fuel vehicle refueling property placed in service during the tax year. Just buy and install. It covers 30 of the costs with a maximum 1000 credit for.

Youll need to know your tax liability to calculate the credit. Congress recently passed a retroactive now includes 2018 2019 2020 and through 2021 federal tax credit for those who purchased EV charging infrastructure. As of 2021 California Florida Texas and Washington account for more than half of.

All-electric and plug-in hybrid cars purchased new in or after 2010 may be eligible for a federal income tax credit of up to 7500. The credit amount will vary based on the capacity of the. A federal tax credit is available for 30 of the cost of the charger and installation up to a 1000 credit means 3000 spent.

Alternative Fuel Vehicle AFV Conversion and Infrastructure Tax Credit. Putting electric vehicle EV charging stations at your commercial property or home is a good investment opportunity especially given the tax credits and incentives available to. Wipflis dealership practice has the.

The credit attributable to depreciable property. All of these things have tax credits associated with them but Im trying to figure out how to get some of it carried over in turbotax instead of losing it. This is in addition to a separate federal tax credit for 30 percent of the chargers cost and.

Atom Power Launches Puprl Ev Charging Solution Charging Directly From Circuit Breaker Green Car Congress

2021 Honda E 高清图片 视频 规格和信息 Dailyrevs Charger Car Electric Car Charger Ev Charger

Electric Vehicle Charger Installation

What S In The White House Plan To Expand Electric Car Charging Network Npr

4 Things You Need To Know About The Ev Charging Tax Credit The Environmental Center

Tax Credit For Electric Vehicle Chargers Enel X

Plant Engineering Considering Electric Vehicle Charging Risks

Commercial Ev Charging Incentives In 2022 Revision Energy

Aiven Group Telsmart Ev Charging Technology Solutions Network Operations Center Business Leader

Morec Mode C Wallbox Ev Charging Stations Ev Charging Electric Vehicle Charging Station

7 Reasons To Offer Ev Charging At Your Business Ev Meter

Electric Car Charging At Home Wattlogic

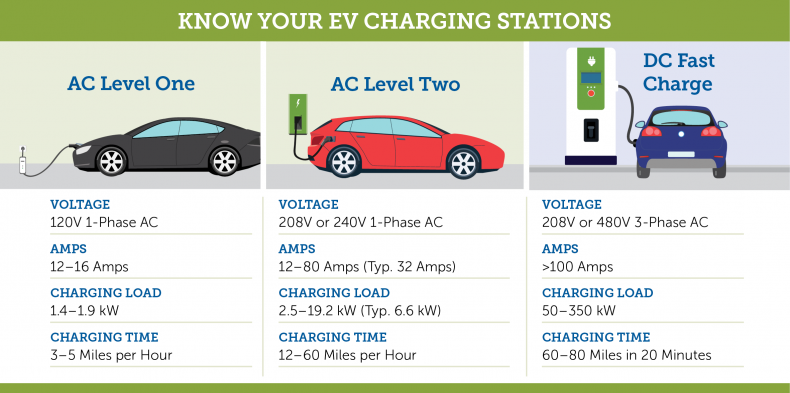

What Are The Different Levels Of Electric Vehicle Charging Forbes Wheels

Eu Countries Urged To Improve Serious Lack Of Ev Charging Points

How To Choose The Right Ev Charger For You Forbes Wheels

Ev Charging Stations 101 Wright Hennepin

Rebates And Tax Credits For Electric Vehicle Charging Stations

The Electric Vehicle Charging Station Infrastructure Supply Chain Game Changer

England To Be First Country To Require New Homes To Include Ev Chargers Business Standard News